How Taxes Work as a 1099 Optavia Coach

I know when I started coaching I called my CPA asking – ok so now I have this side gig what the heck do I do about it regarding taxes?? Please note I am not a CPA / nor professional, this is not legal advice, tax advice or financial advice. This is just what *I* do and a general overview of deductions along with a spreadsheet to help you through.

We get paid via 1099, so we are ‘contract’ employees. The beautiful thing about coaching is there is little to no overhead to get going! But you want to deduct any approved expenses to reduce how much of that income you will pay taxes on. 1099 total income – expenses = taxable income.

There was a point in time where you could deduct the cost of food, but that is no longer a requirement in order to get leads from the website – so you can not deduct any standard monthly food cost.

Some things you can deduct: (always confirm with your CPA)

- Cost of Coach Kit

- Certification Exam

- Portion of your cell phone (ask your CPA for the %)

- Portion of your internet (ask your CPA for the %)

- Travel related to Optavia like conventions (ask CPA)

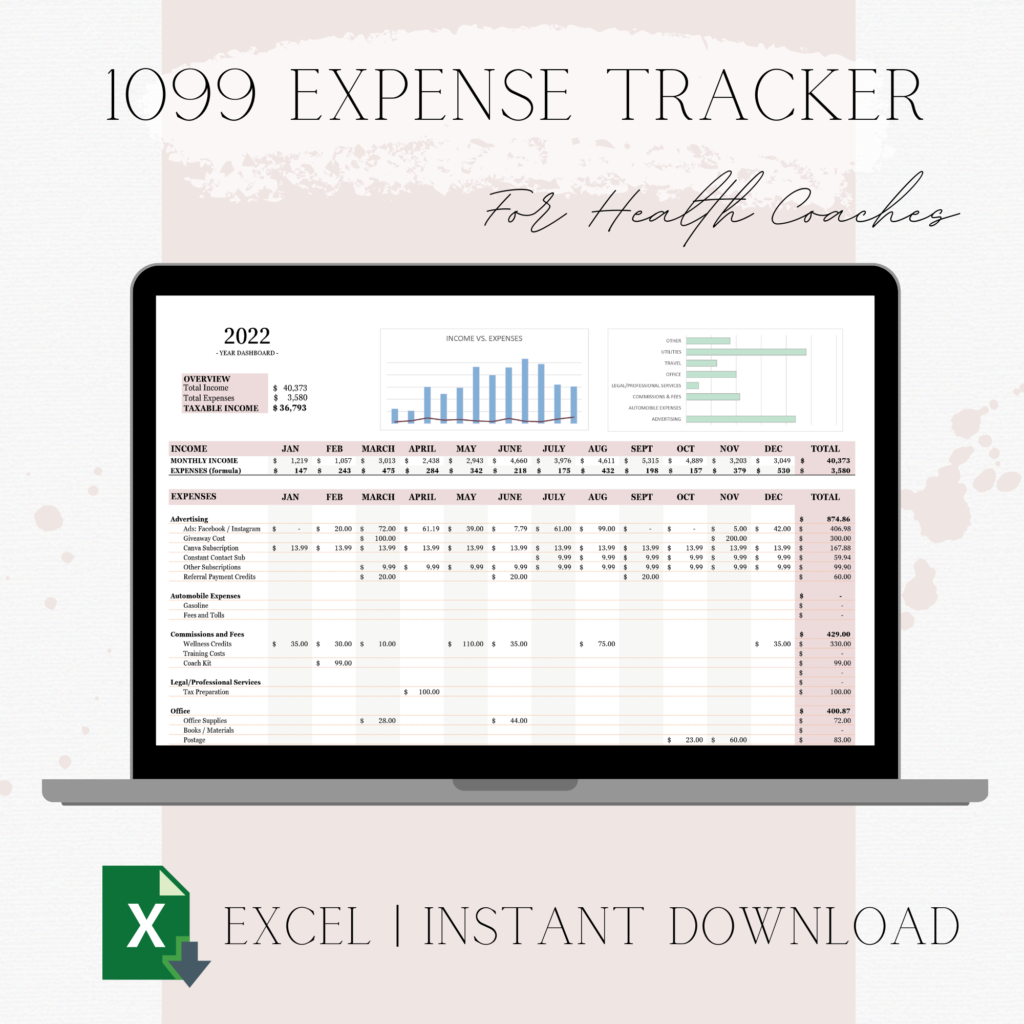

After going through taxes last year with a not-so-great spreadsheet I decided to spend some time making a really good one – this took me weeks to put together and lots of meetings. It’s available on Etsy and you can get 50% off right now for launch with GEO50!

CLICK HERE TO SHOP ON ETSY!

EASY TO USE

AUTOMATIC CALCULATIONS

ADD ALL EXPENSES TO MAXIMIZE DEDUCTIONS!

THIS IS NOT CONSIDERED TAX ADVICE, LEGAL ADVICE, OR FINANCIAL ADVICE, THIS IS A GENERAL STARTING POINT, ALWAYS WORK WITH YOUR CPA FOR YOUR SPECIFIC SITUATION AS ALL RULES VARY.